China boasts a dynamic and rapidly growing economy, making it an attractive destination for many businesses looking to expand operations. Consequently, understanding the intricacies of the Chinese employment landscape is vital, especially when it comes to the social benefits and their proportion in the overall salary structure. Are you curious of how much do Chinese workers get paid? This article aims to provide an in-depth understanding of the Chinese social benefits system, its breakdown, and the proportional contribution to an employee’s total salary.

Overview of Chinese Social Benefits System

To understand how much do Chinese workers get paid, we need to know Chinese social benefits system first. The Chinese government has implemented a comprehensive social benefits system, which includes pension insurance, medical insurance, unemployment insurance, maternity insurance, and work-related injury insurance. Each of these benefits plays a crucial role in safeguarding employees’ rights and welfare.

Pension Insurance

Pension insurance is one of the key components of the Chinese social benefits system. Both employers and employees contribute a proportional percentage of the employee’s salary to the pension fund. The employer’s contribution typically varies between 16-20% of the employee’s salary, while the employee contributes around 8-11%. These contributions ensure that employees can have financial security during retirement.

Medical Insurance

The Chinese medical insurance system offers coverage for both inpatient and outpatient care. Employers and employees both contribute to the medical insurance fund, typically at a combined rate of 10-12% of an employee’s salary. The government subsidizes a certain portion of the premiums to alleviate the financial burden for employees.

Unemployment Insurance

Unemployment insurance provides temporary financial assistance to individuals who have lost their jobs. Employers generally contribute around 1.5-2% of the employee’s salary to the unemployment insurance fund, whereas employees typically contribute around 0.5-1%. The unemployment benefits vary based on the length of service and average salary, providing a safety net during uncertain times.

Maternity Insurance

Maternity insurance ensures that expectant mothers are financially supported during their pregnancy and childbirth. Employers contribute approximately 0.8-1.2% of the employee’s salary to the maternity insurance fund, while employees typically contribute around 0.3-0.8%. Maternity benefits cover a portion of the employee’s salary during the maternity leave period, helping ease the financial strain for new parents.

Work-Related Injury Insurance

Work-related injury insurance provides compensation and medical support to employees who suffer injuries or illnesses resulting from work-related activities. The employer bears the responsibility of contributing to the work-related injury insurance fund, which typically amounts to around 0.5-2% of the employee’s salary. This benefit ensures that employees are protected in case of work-related accidents or illnesses.

House Funding

Additionally, there is the housing fund, also known as the provident fund, which helps employees secure housing. The contribution rates for the housing fund vary, typically ranging from 5-12% of an employee’s salary.

- Are you looking for quality talents worldwide? For a minimum USD 1,500, we will help you hire Chinese employees even you don't have an office in China.

Proportional Breakdown of Social Benefits in Total Salary

When considering the proportional breakdown of social benefits in an employee’s total salary, it is important to note that these contributions vary depending on the specific region and industry. On average, social benefits can account for approximately 25-40% of an employee’s total salary. This breakdown includes the employer’s contributions for pension, medical, unemployment, maternity, and work-related injury insurance, as well as additional fees like housing fund contributions.

Apart from social insurance and the housing fund, there are other benefits and allowances to consider, such as annual leave, public holidays, and overtime pay. These additional benefits can further enhance an employee’s compensation package and contribute to their overall satisfaction.

Understanding Chinese social benefits is crucial for overseas employers. Properly accounting for these benefits can result in cost savings and increased employee satisfaction. Failing to understand the regulations can lead to legal issues and unhappy employees.

How Much Do Chinese Workers Get Paid?

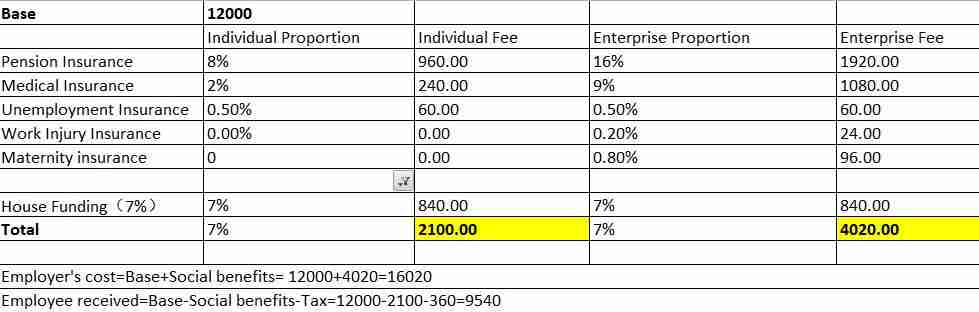

Let’s take a look at the case study in the image to see how Chinese social benefits impact total salary and employee satisfaction.

Based on the social benefits contribution base in Guangzhou, if an employee’s salary is 12,000 CNY, the employer’s social benefits contribution would be 4,020 CNY, resulting in a total employment cost of 16,020 CNY. The employee would need to contribute 2,100 CNY towards social benefits, and after deducting social benefits and taxes, the employee would receive approximately 9,600 CNY in hand.

The housing fund, on the other hand, can be withdrawn by the employee, effectively increasing their salary. Each month, the employee can withdraw an additional 1,680 RMB from their housing fund account. Therefore, the higher the housing fund contribution ratio, the happier the employees.

If you’re interested in hiring Chinese employees and navigating the complex social benefits system, working with a headhunter can provide invaluable guidance and expertise. At our firm, we specialize in helping overseas employers find the right talent and ensure they receive appropriate compensation packages.

Subscribe below for latest news. If you’re ready to take the next step in hiring Chinese employees, please read this page