The port-to-door sea freight rate from China to Rotterdam was more than 2,000 euro in the third quarter of 2020. And now it is more than 9,000 Euros. A lot of Chinese export enterprises have been saying there will be peak season the whole of 2021 for international logistics. But is this peak season too crazy?

Cargo ship containers’ volume increased by 9% year-on-year in the first quarter of 2021

According to statistics from shipping consulting agency Drewry, the global container freight volume increased by nearly 9% year-on-year in the first quarter of 2021. The average China Export Container Freight Index (CCFI) is 1960.99 points. Which increased by 113.33% comparing with the same period in 2020. And also it increased by 56.8% compared with the fourth quarter of 2020!

Evergreen’s container blocked the Suez Canal at the end of March. Which will obviously have an influence on the future rate. The Danish forwarder Vespucci Maritime pointed out that it will take at least 4-6 months for shipping worldwide to return to normal after the Evergreen stranded accident.

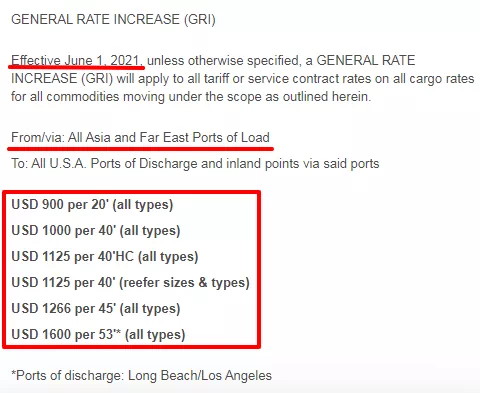

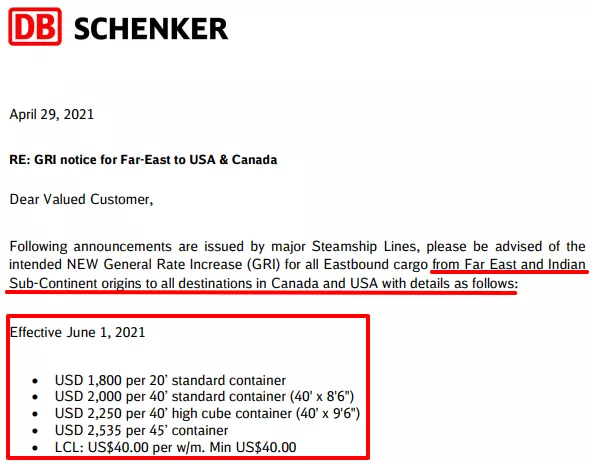

It has been reported that shipping companies are preparing for a new wave of the price increase. The shipowners of the Pan Pacific route are preparing to issue notices of notable increases in freight rates (GRI), which will take into effective from June 1.

China’s Ministry of Transport answers “stranded cargo ship containers, soaring costs”

A lot of Chinese suppliers said that this year’s ocean freight was too abnormal. One supplier from Shandong Province said: “We export products to Poland. The shipping time used to take about 38 days. The total cost was about USD 1,500 for a 20GP container. But at the moment, the ocean freight is soaring. The price is doubled by 3-4 times. Moreover, the containers we ship from Qingdao Port have to stay in Chinese ports for more than one month. Thus, it will take at least 70 days to arrive in Poland at this moment. Moreover, shipping companies are picky with goods’ category and arrival ports.”

And the Ministry of Communications of China responded to this. “Affected by multiple factors, the demand for international container transportation has increased substantially since June 2020. In addition to the necessary repairs and maintenance, the major liner companies have put all their shipping capacity into the market.

The spread of epidemic abroad and the shortage of labor caused the increasing rate

Affected by factors such as the spread of the epidemic abroad and the shortage of labor, ports in the United States, Europe, and other places have experienced serious congestion since the fourth quarter of 2020.

For example, the most crowded ports in the United States, Los Angeles, and Long Beach, currently have more than 30 containers waiting. 85% of arriving containers need to wait at least 8 days until it’s been released from the port. The cargo ship containers stay in the terminal for a maximum of 2 months.

Due to congestion in major ports of call, the entire voyage is lengthened

In addition, European routes generally call at multiple ports. Due to congestion in major ports of call, the entire voyage is lengthened. The congestion of foreign ports, the disorder of the logistics supply chain, and the reduction of efficiency have caused large-scale delays in container liner schedules.

The rising freight rates have become global issues

The on-time rate has dropped from more than 70% to the current 20%. Which has seriously affected the operational efficiency of container ships and aggravated the container ship schedule. The contradiction between shipping capacity and empty container supply and demand and the shortage of shipping capacity, shortage of empty cargo ship containers, and rising freight rates have become global issues. Vietnam, India, South Korea, and other countries have also seen rapid increases in freight rates. The freight rates of some major routes have surpassed that of China.

Regarding the above situation, our ministry attaches great importance to actively coordinating with relevant liner companies to optimize the allocation of shipping capacity on Chinese routes, increase the capacity of Chinese routes and the return of empty containers, and minimize the large-scale delays in shipping schedules caused by congestion in overseas ports’ influences.”

Financial reports of major shipping companies in the first-quarter of 2021

Maersk’s first-quarter profit set a record

On May 5, A.P. Mueller-Maersk released the first quarter of the 2021 financial report. The company’s performance has started exceptionally strong in 2021. And all business sectors including shipping, port services, and logistics have achieved relatively high returns and growth.

Overall, in the first quarter, EBITDA profit increased from US$1.5 billion in the same period last year to US$4 billion. EBIT earnings increased from US$552 million to US$3.1 billion. Revenue increased by 30% to $12.4 billion.

The Maersk expects indicate that the market-supply chain bottlenecks and shortages will continue until the fourth quarter of 2021.

COSCO SHIPPING Holdings makes 170 million yuan a day

On the evening of April 29, COSCO SHIPPING Holdings disclosed its first quarterly report for 2021. It achieved a net profit of 15.45 billion yuan attributable to its parent in the first-quarter of 2021, a year-on-year increase of 5200.62%. In other words, COSCO Shipping Holdings made an average daily profit of 170 million yuan in the first quarter.

The Asia-Europe (including Mediterranean) routes doubled in revenue from the COSCO SHIPPING lines. Which made outstanding contributions to the surge in COSCO SHIPPING’s performance. Data show that Asia-Europe, Asia intra-Asia, and trans-Pacific routes achieved revenues of 12.306 billion yuan, 9.661 billion yuan, and 8.935 billion yuan, respectively, representing a year-on-year increase of 136.93%, 69.18%, and 75.70%.

Evergreen Shipping’s performance hits a record high

Although its container ships blocked the Suez Canal and faced sky-high compensation, Evergreen Shipping broke the best quarterly performance in its history in the first quarter of this year-Evergreen Shipping received NT$90.236 billion (approximately RMB 20.756 billion). Yuan), a year-on-year increase of 108% and a quarterly increase of 39.4%.

The substantial growth in Evergreen Shipping’s operating revenue was mainly due to the strong import momentum in the United States, the surge in freight rates, and the simultaneous surge in freight rates from Asia to Europe. Last year, Evergreen Shipping had 44% of its revenue from the Americas and 24% from Europe.

Xie Huiquan, general manager of Evergreen Shipping, pointed out that the global port congestion problem is difficult to alleviate. Because the supply of container spaces is in short supply, especially the serious congestion of West America Port.

HMM turned a loss to profit for the first time in 10 years

Due to soaring freight rates in 2020, South Korea’s HMM (formerly Hyundai Merchant Marine) achieved its first profit since 2011. According to an insider in the Korean securities industry on April 11, the operating profit realized by HMM (formerly Hyundai Merchant Marine) and SM Merchant Marine in the first quarter of this year is likely to exceed the operating profit for the entire year of last year. If this performance situation continues, HMM’s annual operating profit will exceed 3 trillion won (approximately US$2.68 billion) this year.

Subscribe below if you want to get informed of the latest shipping news. If you are interested in buying product from China at a competitive price, please read this page